Unlocking Finance for the Ocean

We are on a mission to unlock finance for projects that fix the ocean.

Powered by AI, grounded in science, and designed for impact.

Athena Blue transforms ocean initiatives into finance-ready opportunities that deliver climate resilience and ocean health.

- →The Ocean is our largest carbon sink and absorbs more than 30% of excess CO2e emissions and it is key to meeting Net Zero goals

- →If the Ocean Economy was a country it would be the fifth largest economy in the world. It is valued at over $1.5 trillion with growth projected to $3 trillion by 2030.

- →But the Ocean is in crisis and lack of finance is exacerbating the problem.

The Scale of the Challenge

Understanding the barriers that prevent critical ocean restoration projects from accessing the funding they desperately need.

Underinvestment Crisis

SDG14 (Life Below Water) is the least funded of all the UN goals, with a finance gap estimated to be over $175 billion.

Of all global philanthropy, the ocean receives just 1% of funding.

Promising projects struggle to access private finance to scale their solutions.

The gap between what projects need and what they are receiving is vast.

Project-Funder Disconnect

Many ocean initiatives are too nascent or early stage for traditional funders and remain overlooked.

Conventional due diligence process is lengthy, clunky, and time-consuming.

There are no standardised frameworks for assessing the readiness of early-stage projects.

Fragmented opportunities and limited data result in a lack of an investable pipeline.

The Opportunity

Athena Blue bridges the gap between the vast potential of ocean projects and the lack of finance to scale. Starting with blue carbon ecosystems we work with projects to develop high-quality pathways to deliver impact: carbon, biodiversity, and social.

The Blue Carbon Opportunity

Blue carbon ecosystems—mangroves, seagrass meadows, and salt marshes—represent one of nature's most powerful climate solutions.

3-5x more carbon storage per hectare than tropical forests

80% reduction in storm surge through coastal protection

Biodiversity hotspots supporting marine life cycles

Community benefits through sustainable livelihoods

The Solution: Systematic Pipeline Development

Athena Blue addresses these challenges by creating the infrastructure for an investable blue carbon pipeline.

We don't replace existing expertise—we enhance it

Financial readiness components unlock funding

Systematic approach to scale impact

Ready to Drive Ocean Impact?

Whether you are a corporate looking for high-impact opportunities or a project seeking to become finance-ready, Athena Blue provides the tools and connections you need.

For Corporates: Access to Vetted Opportunities

Curated Project Pipeline

Standardised due diligence and early access to emerging opportunities before public markets.

AI-Powered Due Diligence

Dynamic AI conversations, document analysis, and progress tracking for comprehensive project evaluation.

For Projects: Your Path to Finance Readiness

Transform your blue carbon vision into a fundable opportunity with our comprehensive finance readiness platform designed specifically for ocean restoration projects.

Finance Readiness Assessment

Comprehensive evaluation covering financial structure, impact measurement, market positioning, and corporate requirements.

Financial Structure Analysis

Revenue models, cost projections, risk assessment

Impact Measurement Framework

Carbon quantification, biodiversity metrics, community benefits

Market Positioning

Advice and guidance on navigating the market

Corporate Requirements

Meeting criteria for high-integrity impact

Who We Are

Athena Blue is building the pipeline of high-impact Blue Economy projects powered by AI, grounded in science, and designed for impact.

Catch up with Us At..

September: Blue Finance Summit (London)

October: Blue Earth Summit (London)

November: Seagrass Symposium (Cardiff)

UNOC in Nice, France - June 2025 (Past)

Blue Economy Finance Forum in Monaco - June 2025 (Past)

European Seagrass Restoration Alliance conference in Arcachon - May 2025 (Past)

Our Story

Athena Blue launched in response to the need to urgently unlock finance to ocean projects. Our Founder, Kirsty Schneeberger MBE, had previously led deals in the Voluntary Carbon Market securing finance for early-stage ocean projects. Recognising the need to systematise and scale this approach, she set up Athena Blue to address the challenges to financing ocean projects head-on.

Meet Our Team

World-class expertise in climate finance, policy, and ocean restoration.

Leadership

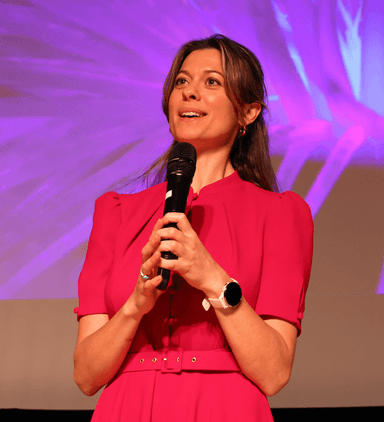

Kirsty Schneeberger, MBE

Founder & CEO

18+ years climate change experience. Former advisor to Christiana Figueres for Paris COP21. Former Charity CEO managing $25M portfolio. Raised $30M+ for environmental projects.

Core Team

Laura Hurley

Policy Expert

15 years policy experience specializing in carbon removals and environmental regulation

Joy Williams

Carbon Finance Expert

25+ years finance experience, former GFANZ technical lead with deep VCM expertise

Gabrielle Brophy

Operations Lead

15 years high-impact project management and operations experience

Get in Touch

Select your role to get started. Whether you're a project developer or a potential corporate investor, we want to hear from you.